Bond Markets

Bloomberg bond market news

Chadha, the chief global strategist at Deutsche Bank’s U.S. securities unit, is part of a group of die-hard bond bears who say Treasuries have become unhinged from reality and yields have nowhere to go but up. Like many before him, he points to all the obvious signs investors seem to be ignoring: higher…

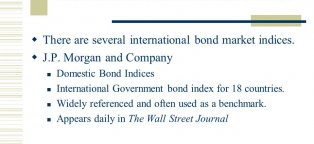

Bond market indices

FTSE TMX Global Debt Capital Markets (formerly PC-Bond / DEX) is the predominant provider of fixed income indices in Canada, best known for the Universe Bond Index, and also is the leading provider of Gilt (UK government bond) indices and also a significant fixed income player in international markets…

bond market volume

Bonds are far more important than most investors give them credit for. Image source: U.S. Treasury. The bond market doesn t get nearly as much attention among most investors as the stock market, as most people are lured by the opportunity to see their investments skyrocket in value over the long run…

bond market primer

Bond Connect program in Hong Kong seen as a stepping stone Concerns about repatriation have limited foreign purchases After China finally got a start on seeing its local stocks into global equity indexes, focus turns to what could be an even bigger deal - winning inclusion into the world’s benchmark…

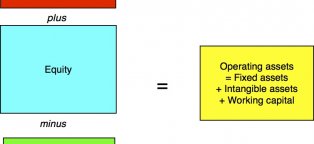

Bond market value formula

Bonds can be priced at a premium, discount, or at par. If the bond s price is higher than its par value, it will sell at a premium because its interest rate is higher than current prevailing rates. If the bond s price is lower than its par value, the bond will sell at a discount because its interest…

Bond market structure

FINRA and Columbia Joined Forces to Hold High-Level Conference on the Bond Market Leaders from Academia, Industry, and the Regulatory Community Discuss Debt Securities Market Structure, Liquidity, and Volatility Financial experts from academia, industry, and the regulatory community gathered on November…

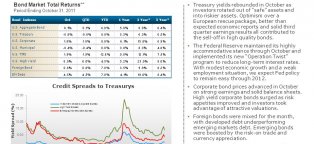

Bond market Review

The Federal Reserve is subject to a dual mandate: price stability and maximum employment. Although the unemployment rate is the most commonly reported labor market statistic, since the end of the great recession, analysts have correctly observed there are several other methods of measuring the labor…

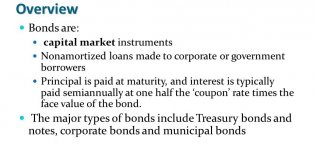

bond market securities

The bond market – also called the debt market or credit market – is a financial market in which the participants are provided with the issuance and trading of debt securities. The bond market primarily includes government-issued securities and corporate debt securities, facilitating the transfer of capital…

bond market size by country

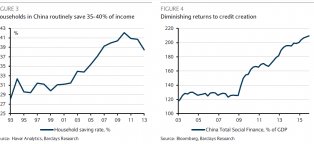

China’s domestic bond market is now the third largest in the world and is opening for business to foreign investors. By our estimate, China’s total bond market capitalization reached 74.4 trillion yuan (US$10.7 trillion), at the end of 2016, making it the third largest market after the United States…

Best Emerging market bond Funds

Emerging market bond funds are not for the faint of heart. If you’re willing to deal with the volatility, emerging market bond funds — made up of bonds from countries such as Russia, Brazil, Mexico, and Turkey — offer excellent return potential. Fidelity New Markets Income Fund (FNMIX) Contact: 800-544-;…

Bond market Association holidays

Search for Other Articles By Author Article Citation: Susan M. Albring, Lillian F. Mills, and Kaye J. Newberry (2011) Do Debt Constraints Influence Firms Sensitivity to a Temporary Tax Holiday on Repatriations?. The Journal of the American Taxation Association: Fall 2011, Vol. 33, No. 2, pp. 1-27. MAIN…

bond market predictions

The $13.8 trillion Treasuries market suffered its worst slump since 2001 after Trump’s win, stoking worries that a persistent increase in yields could make his spending plans more costly. His proposals would boost the nation’s debt by $5.3 trillion, according to the nonpartisan Committee for a Responsible…

bail bonds marketing

We understand you have a lot to deal with as you run your own business. The bail industry is tough. You are dealing with day-to-day issues in order to keep your business running. Because of this, it can be difficult to put the time and energy necessary into your online bail bonds marketing strategy…

Bond market Commentary

Declining Credit Creating Opportunities The U.S. investment-grade (IG) corporate bond market benefits from a sound U.S. Banking sector, good liquidity among highly-rated Industrials, accommodative monetary policy and improved valuations. Key risks include weakening corporate profits, elevated mergers…

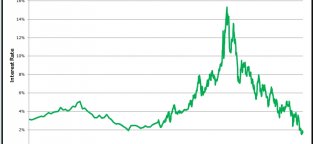

Bond market crash 1994

Investors could be setting up a repeat of 1994 s bond-market chaos, according to Deutsche Bank s Torsten Sløk. From January to September of that year, the yield on the long 30-year bond spiked about 200 basis points, costing investors up to $1 trillion in losses. Fortune magazine called it the great…

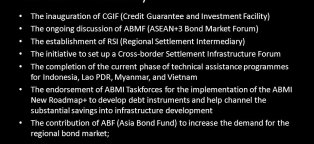

Asian bond Markets Initiative

Good Practices in Developing Bond Market: with a focus on government bond market ASEAN+3 and Asian Development Bank (ADB) together issued a paper, Good Practices in Developing Bond Market,which discusses key building blocks of bond markets, particularly government bond markets, and successful efforts…

bond market open

This past Wednesday, the People’s Bank of China and the Hong Kong Monetary Authority announced a joint cooperation to launch “Bond Connect”, with no exact timing given. Bond Connect is the formalisation of allowing two-way bond investment, trading, custody, and settlement. The announcement says that…

bond market history

Decades of trading shows yields typically fall from May-Sept. This year, looming European political tension also at work If history is any guide, bond investors should be wary of piling into bets that Trump administration policies will jolt the U.S. economy into high gear and drive up Treasury yields…

Bond market blog

Guest contributor – Simon Duff (Credit Analyst, M&G Credit Analysis team) Last week, International TV network operator Discovery Communications announced the US$15bn acquisition of Scripps Networks. Scripps owns TV networks focused on food, home and travel, so it fits with the factual or “non-scripted”…

Bond market equilibrium

Supply function shows the relationship between the quantity supplied and the market price, when we hold all other economic variables constant. We drew a supply function in Figure 2. Supply function has a positive slope because as you move from point A to point B, the price becomes higher while the market…

Bond market Indicators

It looks like the bond market is not buying into hopes for economic growth. As of late Monday trading, the 10-year U.S. Treasury note was trading at a yield of 2.25 percent per year, while the two-year note yielded 1.28 percent per year. At 0.97 percentage point, the spread between the longer-maturity…