Bond market value formula

Bonds can be priced at a premium, discount, or at par. If the bond's price is higher than its par value, it will sell at a premium because its interest rate is higher than current prevailing rates. If the bond's price is lower than its par value, the bond will sell at a discount because its interest rate is lower than current prevailing interest rates. When you calculate the price of a bond, you are calculating the maximum price you would want to pay for the bond, given the bond's coupon rate in comparison to the average rate most investors are currently receiving in the bond market. Required yield or required rate of return is the interest rate that a security needs to offer in order to encourage investors to purchase it. Usually the required yield on a bond is equal to or greater than the current prevailing interest rates.

Bonds can be priced at a premium, discount, or at par. If the bond's price is higher than its par value, it will sell at a premium because its interest rate is higher than current prevailing rates. If the bond's price is lower than its par value, the bond will sell at a discount because its interest rate is lower than current prevailing interest rates. When you calculate the price of a bond, you are calculating the maximum price you would want to pay for the bond, given the bond's coupon rate in comparison to the average rate most investors are currently receiving in the bond market. Required yield or required rate of return is the interest rate that a security needs to offer in order to encourage investors to purchase it. Usually the required yield on a bond is equal to or greater than the current prevailing interest rates.

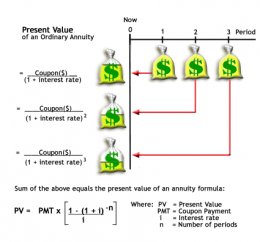

Fundamentally, however, the price of a bond is the sum of the present values of all expected coupon payments plus the present value of the par value at maturity. Calculating bond price is simple: all we are doing is discounting the known future cash flows. Remember that to calculate present value (PV) - which is based on the assumption that each payment is re-invested at some interest rate once it is received-we have to know the interest rate that would earn us a known future value. For bond pricing, this interest rate is the required yield. (If the concepts of present and future value are new to you or you are unfamiliar with the calculations, refer to Understanding the Time Value of Money.)

Here is the formula for calculating a bond's price, which uses the basic present value (PV) formula:

C = coupon payment

n = number of payments

i = interest rate, or required yield

M = value at maturity, or par value

The succession of coupon payments to be received in the future is referred to as an ordinary annuity, which is a series of fixed payments at set intervals over a fixed period of time. (Coupons on a straight bond are paid at ordinary annuity.) The first payment of an ordinary annuity occurs one interval from the time at which the debt security is acquired. The calculation assumes this time is the present.