Bond Markets

Guide

Halo 5 infection tips when making gamemode in what cell organelle does photosynthesis occur How to lower estrogen all fire extinguishers are labeled with a letter and a number. what does the number indicate? How to get rid of sulfur…

Reference

How to wash white vans? what time does trump leave the white house what does hrv stand for How to toast pecans How to close apps on apple tv How long does it take a stye to go away? How to act what are the six games in squid game in order what does archaic mean what does pff mean in football How to stay…

Links

Tricks when taking pulse How to thaw frozen breast milk How to get rid of varicose veins? How to donate eggs what temperature does chicken need to be cooked to How to make ginger tea How does 2 infinite combo combat tricks work How to do card tricks chinese magician How to calculate federal tax on the…

Interesting

How to change password on facebook? Linus tech tips how to clean brushed aluminium How to find registry on amazon Tips how to play badminton How to learn russian? Mut 17 what to do with bronze tips How magic tricks work How to remove table formatting in excel How to set up voicemail on iphone 12? How…

Useful

Decor tips how to keep cats from scratching walls How to get free apple music What is home screen tips app Card game where you bet how many tricks you can win How long does it take to smoke a pork butt How to keep pins on the map code html css css tricks How does apollo do hit coin tricks Tips on how…

Sources

How often does favorite win super bowl? what transfer case is in a 2001 chevy 2500hd whom challenge game? how to make money which influence skin badly when touched which marketing job pays the most? which marketing strategy is most effective? how grow taller whom direct object when your favorite person…

Our partners

Where to import bootstrap in react? Who s theory is constructivism? Which blogger has the most followers? Which working environment is more user friendly? How to measure leadership performance? Where to buy degree certificate in nigeria? When questions with pictures? How many algorithms are there? When…

Reference Guide

Who is maintenance mechanic whose operations influence the betterment of the countries who questions for kids when career readiness what industries use python? which degree is the highest? how much grow big should i use? where subject meaning? how much leader should i use? how many classification of…

Resources

Stylish beds autism communication cards christmas sweets outdoor kitchen units communication in care settings what is a business plan used for care international how to see worldwide trends on twitter stylish brother a cardinal i have a business idea now what how to create a business email with gmail…

Bond market update

The Briefing.com RSS (really simple syndication) service is a method by which we offer story headline feeds in XML format to readers of the Briefing.com web site who use RSS aggregators. By using Briefing.com’s RSS service you agree to be bound by these Terms of Use. If you do not agree to the terms…

bond market outlook

(Reuters) - U.S. Treasury bond yields are set to rise this year, but not as much as many currently expected, according to a Reuters poll of top fixed-income strategists who appear skeptical the Federal Reserve will manage to raise rates several times more this year. Central banks, not finance ministries…

Bond market research

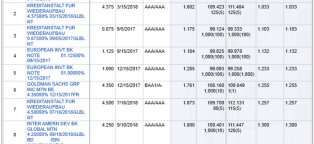

Tobias Adrian, Michael Fleming, Erik Vogt, and Zachary Wojtowicz Our earlier analyses from last October and earlier in this series looked at market liquidity measures averaged across all corporate bonds or broad sub-groups of corporate bonds. Commentators have pointed out that such broad averages might…

Bond market basics

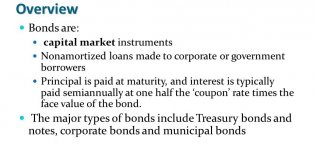

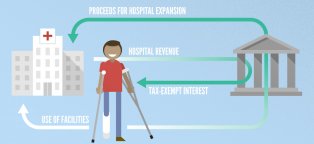

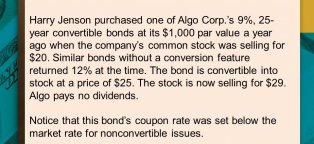

Long before there were corporations that issued shares of stock for investment, there was the systematic use of debt to raise money. Debt involves borrowing money with the promise to pay it back in full, along with interest over time. The guaranty assuring that promise is known as a bond. In other words…

Bond market close time

Financial markets in the U.S. will be closed on Monday for the observance of Memorial Day, in honor of men and women who died while serving in the U.S. military. The stock and bond market will remain closed, while trading in all Globex contracts will be halted from 1 to 6 p.m. Eastern. Oil futures will…

Bonds market Yields

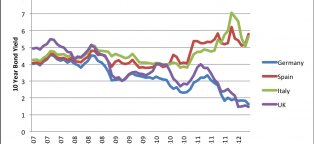

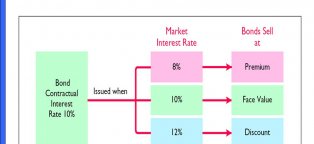

A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of the bond, and current yield which equals annual earnings of the bond divided by its current market price. Additionally…

Bond market basics PDF

When you buy a bond, either directly or through a mutual fund, you re lending money to the bond s issuer, who promises to pay you back the principal (or par value) when the loan is due (on the bond s maturity date). In the meantime, the issuer also promises to pay you periodic interest payments to compensate…

Bond market performance today

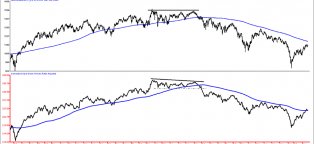

Millions of Americans, he observed, “are engaging in a variety of risky behaviors, often without knowing what they’re doing. They’re setting themselves up to lose a lot of money over the next several years, perhaps as much as they lost in 2008 in stocks.” “You could see 20%, 30%, 40% losses in the bond…

Bond market closures

The New York Stock Exchange will close Monday as Hurricane Sandy makes landfall. The New York Stock Exchange said in a statement late Sunday that it would close its markets Monday. Markets are likely to remain closed on Tuesday as well. The Nasdaq stock market, which trades many technology stocks, including…

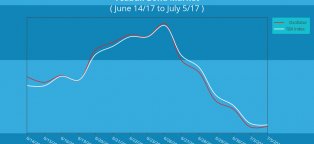

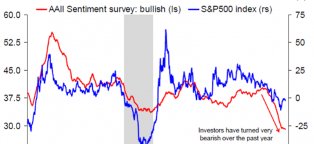

Bond market trends

Another day, another sign of just how calm global financial markets have become. On Monday, the Vix index, Wall Street’s so-called “fear gauge” that reflects investors’ expectations of volatility in the benchmark S&P 500 Index over the next month, dropped to its lowest level since February 2007…

Arbitrage in the Government bond market

Note: Quantity pricing discounts will be reflected at Checkout, prior to submitting your order. When you place your first order on HBR.org and enter your credit card information and shipping address, Speed-Pay ordering is enabled. Speed-Pay is a service that saves the credit card details from your…

bond market hours today

When investing in bonds, you can buy the bond directly from the underwriter or financial institution, or you can buy - and sell - bonds on a bond market exchange. If you want to trade a bond on a market exchange, you re limited to the trading hours of the exchange that you re using. Bonds typically trade…