bond market securities

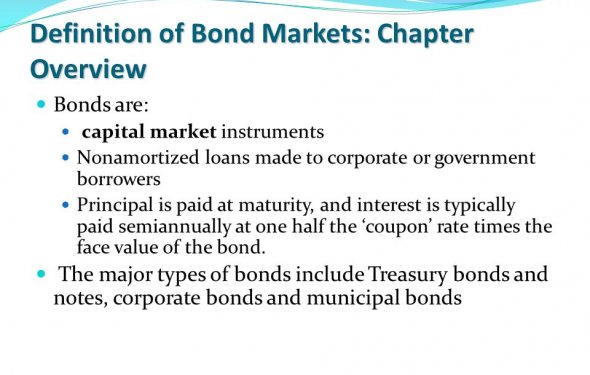

The bond market – also called the debt market or credit market – is a financial market in which the participants are provided with the issuance and trading of debt securities. The bond market primarily includes government-issued securities and corporate debt securities, facilitating the transfer of capital from savers to the issuers or organizations requiring capital for government projects, business expansions and ongoing operations.

BREAKING DOWN 'Bond Market'

In the bond market, participants can issue new debt in the market called the primary market or trade debt securities in the market called the secondary market. These products are typically in the form of bonds, but they may also come in the form of bills and notes. The goal of the bond market is to provide long-term financial aid and funding for public and private projects and expenditures.

Participants

The participants of the bond market are nearly the same as the participants in other financial markets. In bond markets, the participants are either buyers of funds (that is, debt issuers) or sellers of funds (institutions). Participants include institutional investors, traders, governments and individuals who purchase products provided by large institutions. These projects may be in the form of pension funds, mutual funds and life insurance, among many other product types.

Types of Bond Markets

The general bond market can be classified into corporate bonds, government and agency bonds, municipal bonds, mortgage-backed bonds, asset-backed bonds, and collateralized debt obligations.

Corporate Bond

Corporations provide corporate bonds to raise money for different reasons, such as financing ongoing operations or expanding businesses. The term "corporate bond" is usually used for longer-term debt instruments that provide a maturity of at least one year.

Government Bonds

National governments issue government bonds and entice buyers by providing the face value on the agreed maturity date with periodic interest payments. This characteristic makes government bonds attractive for conservative investors.

Municipal Bonds

Local governments and their agencies, states, cities, special-purpose districts, public utility districts, school districts, publicly owned airports and seaports, and other government-owned entities issue municipal bonds to fund their projects.

Mortgage Bonds

Pooled mortgages on real estate properties provide mortgage bonds. Mortgage bonds are locked in by the pledge of particular assets. They pay monthly, quarterly or semi-annual interest.