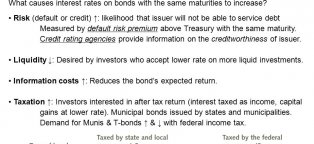

Rate

Helpful

Who grow crops in the field? what career path should i take how object is created in c++ whose work led to a periodic table? which algorithm is non tractable where math is used in everyday life? why career development is important?…

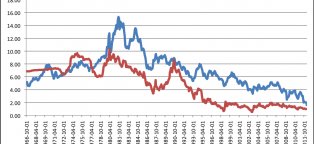

BBB bond rates

(The following statement was released by the rating agency) NEW YORK, May 16 (Fitch) Fitch Ratings has assigned a - rating to the expected senior unsecured notes due 2027 issued by EPR Properties (NYSE: EPR). Net proceeds are expected…

Here is your path to find true excitement and fun. this is best platform with more than 1000 game option from 100+ game provider to play, and operate in 5 country accross south east asia. We are known the best in sport game especially for sbobet88 ibc and bti with best odds you can find in the market. Get Bonus for new member and claim highest rebates rates every day. Our 24 hours customer support ready to help you. So Join now and get best special Deals offer for new register ember.

Market rate of bonds

Calculate the market value of a bond by comparing interest rates. Calculator image by Alhazm Salemi from Fotolia.com The market price of a bond is determined using the current interest rate compared to the interest rate stated on the bond. The market price of the bond comprises two parts. The first part…

Return rate on bonds

A rate of return is the gain or loss on an investment over a specified time period, expressed as a percentage of the investment’s cost. Gains on investments are defined as income received plus any capital gains realized on the sale of the investment. Rate of return can also be defined as the net amount…

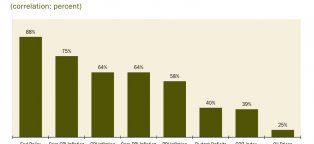

Bond market and mortgage rates

Bond rates directly affect mortgage rates since they attract similar buyers. Bond rates directly affect mortgage rates. This may seem a bit strange, but there are logical reasons for this effect. Most mortgage loans are sold into the secondary market. The secondary market then sells pools - groups…

Government bonds rates of return

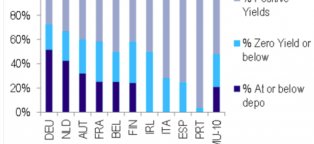

Interest rates around the world, both short-term and long-term, are exceptionally low these days. The U.S. government can borrow for ten years at a rate of about 1.9 percent, and for thirty years at about 2.5 percent. Rates in other industrial countries are even lower: For example, the yield on ten-year…

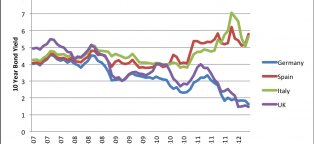

Euro bond rates

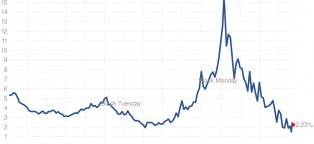

Eurozone government bond yields shot higher on Thursday after European Central Bank President Mario Draghi said there’s no longer a “sense of urgency” over the need to take additional measures to support the eurozone economy. The ECB chief also said the central bank’s Governing Council didn’t discuss…

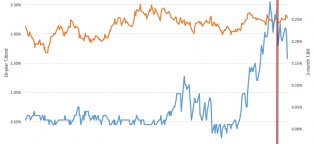

10 years government bond rate

The U.S. bond market pulled back Monday, pushing up the yield on the benchmark 10-year Treasury note from its lowest level in more than six months. Some investors sold bonds to book profit following last Friday s price rally driven by a disappointing U.S. employment report. The bond market pared its…

Market interest rate bond

I think there s a fundamental rethink in the near-term outlook, as it relates to expectations for growth and also (Federal Reserve) policy. All of this has to do with increased optimism that there will be some fiscal stimulus in the near term and some type of deregulation, both of which will underpin…

Historical bond rates

Historical bonds are those bonds that were once valid obligations of American entities but are now worthless as securities, are quickly becoming a favorite tool of scam artists. Here are several things that you should know about them: Types of Historical Bonds Used for Fraud Although all sorts of historical…

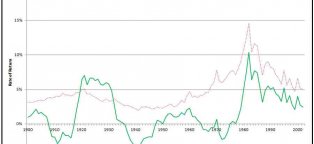

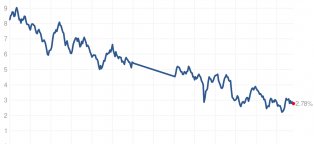

30 year bond rate history

However, the final yield is only likely to emerge once the transaction is formally priced on Wednesday. Reducing risk Late last week, the AOFM appointed a panel of six banks to lead manage the transaction - ANZ, Citi, Commonwealth Bank, Deutsche Bank and Westpac. The 30-year bond is part of the AOFM…

Historical government bond rates

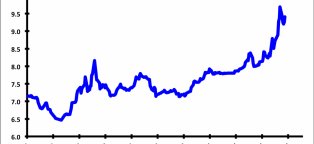

The UK s King George in his coronation robes, in 1761. European governments are borrowing money at the cheapest rates in hundreds of years. One country is actually borrowing at the lowest rates in nearly 500 years. Bank of America Merrill Lynch s researchers have published the historical bond yields…

average bond rate

While many novice investors understand the basics of the stock market, many have an understanding of the bond market that’s hazy at best. It’s understandable, as bond prices don’t follow conventional wisdom that governs pricing across the rest of the market, and financial publications focus less coverage…

Bank bonds rates

A sell-off in global bonds continued on Friday, as the realization set in that the end is near for policies that have kept interest rates exceptionally low for a decade. A speech this week by Mario Draghi, the president of the European Central Bank, signaled at best a very small change in the direction…

treasury bonds rates today

If you think the financial panic over Brexit is over — because stocks have bounced back somewhat from their initial sell off — think again. As scared investors continue to seek shelter in boring government bonds, fixed income prices have soared while yields on 10-year Treasury securities plummeted to…

Federal bonds rates

The Federal Open Market Committee s statement containing key language that points to starting rolling back the Fed s balance sheet in September. The committee expects to begin implementing its balance sheet normalization program relatively soon, provided that the economy evolves broadly as anticipated,the…

International bond Yields

One of the occupational hazards of being a professional economist writing for a broader audience is that sometimes you lose track of what is and isn’t obvious to smart people who haven’t spent their lives immersed in your field. (Actually, the same problem arises in teaching undergraduates.) So I welcome…

Yahoo bond rates

An advanced bond search function operates as a bond screener. Users can input debt or asset class (Treasury, corporate, municipal or securitized products), issuer or bond type, coupon and interest, maturity date and ratings and credit; they can also select whether the bond includes or excludes options…

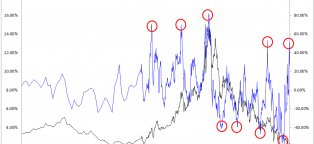

High yield bond rates historical

Release: BofA Merrill Lynch Units: Percent, Not Seasonally Adjusted Frequency: Daily Notes: This data represents the effective yield of the BofA Merrill Lynch US High Yield Master II Index, which tracks the performance of US dollar denominated below investment grade rated corporate debt publically issued…

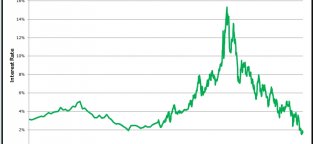

10 year bond mortgage rates

Interest rates are at their lowest levels in years. That s because the 10-year Treasury note yield fell to 1.46 percent July 1, 2016. Investors fled from European investments after Great Britain voted to leave the European Union. The yield rebounded after Donald Trump won the 2016 presidential election…

Foreign bonds rates

Shooting for extra income? It can pay to venture offshore. Yields on bonds issued by foreign governments and companies often beat comparable U.S. rates. Moreover, central banks in Europe and Japan recently cut interest rates, while the Federal Reserve has embarked, gingerly, on the opposite path. Such…