Bond Markets

Bond market returns

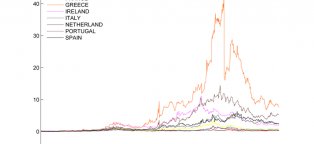

Welcome back, Greece. The long-suffering country on Tuesday returned to bond market for the first time since 2014, pricing 3 billion euros ($3.5 billion) of new five-year bonds at a yield of 4.625% and attracting more than €6.5 billion…

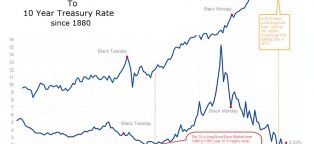

bond market history chart

The starting point of any financial analysis must surely be a consideration of the economic cycle: not just where we stand within the current cycle, but more importantly, where that cycle fits within broader economic history,writes Paul Jackson in his final note to clients in his role as an equity strategist…

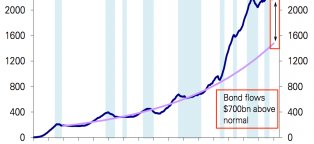

Bond market Bloomberg

While Bloomberg is commonly used across asset classes, it is perhaps most prevalent within the bond market. While some individuals may shy away from the bond market due to its institutional nature, even these investors will find that monitoring the bond market will help them better understand movements…

bond market india

By Kartik Goyal India’s $750 billion sovereign-debt market is caught in a tug of war between foreign investors and state-run banks, the biggest holders of the securities. As lenders sold 952 billion rupees ($14.7 billion) of sovereign bonds last quarter, overseas funds added more than 422 billion rupees…

Argentina bond market

Keystone/Hulton Archive/Getty Images A lot has happened in Argentina in the past 100 years, including the rise of the radical populist movement behind Juan and Evita Peron. A military coup. A world war. A radical government. A terrorist campaign. Losing a war against the British over some fairly insignificant…

bond stock market

The stock market clambered to records on Friday, while government bonds remained in rally mode, pushing the benchmark 10-year Treasury note yield to a seven-month low, marking a puzzling dynamic on Wall Street. Why? Because Treasury prices, which move inversely to yields, tend to climb when investors…

Bond market closing time

Anyone who is active in the stock market knows how important it is to know when the stock market is open and when it is closed. If you think the market is closed when it is actually open, missing a day when the stock market is active could make a huge difference in your investment portfolio. When a holiday…

bonds definition stock market

A bond is a debt investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or fixed interest rate. Bonds are used by companies, municipalities, states and sovereign governments to raise money and finance…

Bond market Meaning

Back in the old days, investors owned actual paper copies of corporate bonds. Photo: Stockbyte/Getty Images Definition: Bonds are loans made to large organizations. These include corporations, cities and national governments. A bond is a piece of a massive loan. That’s because the size of these entities…

Deep cleaning

Photo by Pixabay.com What is really good for commercial work ? Clean offices! Professional cleaning means not just surface cleaning, but full-fledged activity aimed at maintaining the care of carpets, furniture, office equipment, etc. If you want your office meeting room to make only positive impressions…

Bond market Bubble burst

“Looking back over eight centuries of data, I find that the 2016 bull market was indeed one of the largest ever recorded, ” he wrote, using this chart for some perspective on the 36-year run bond run. “Only two previous episodes — the rally at the height of Venetian commercial dominance in the 15th century…

Bond market graph

Many retail investors shun the bond market because it can be difficult to understand and it doesn t offer the same level of potential upside as the stock market. While the bond market is different from the stock market, it can t be ignored. Its size (comparable to the stock market) and depth will ensure…

australian bond market

Thank you for inviting me to talk at the Economic Society here in Canberra. Today I am going to walk you through the current state of the Australian bond market. The bond market plays an important role in the financial structure of the Australian economy and it is timely to examine its structure and…

Bond market calendar

One of my favorite market anomalies is well underway, and it likely has meaningful implications for Seeking Alpha s fixed income investors. Since the advent of the modern high-yield debt market in the early 1980s, there has been a bankable calendar trade that has persisted. In the table below, readers…

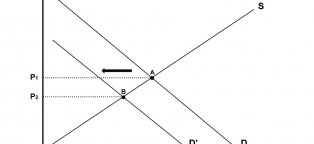

Bond market Bubble

Bonds issued by governments and companies are priced high these days. In the seesaw relation of bond prices to their yields, prices are up, and yields are smacking hard against the ground, at record lows. Investors, wary of stock valuations and looking desperately for yield, have poured money into bonds…

bond market crisis

Fed releases semi-annual monetary policy report to Congress Fed views financial stability risks modest despite price gains The Federal Reserve acknowledged that post-crisis financial regulations may be crimping bond-dealers’ incentives to make markets, while also saying that the impact on liquidity appears…

Bond market risk

Whether a bond pays the investor a fixed interest rate (also known as the coupon rate), which cannot be changed during the life of a bond, or a variable interest rate, the market price of a municipal bond will vary as market conditions change. If you sell your municipal bonds prior to maturity, you will…

Bond market value calculator

Bond values are very sensitive to market interest rates. For example, if you purchased bond with a stated/coupon rate of 10% and market rates had declined to 8% since you purchased the bond, then the value of your 10% bond in a market crediting 8% would be higher. Use this calculator to help determine…

Bond market PDF

The segment bond market contains all bonds that have been admitted to listing on the Official Market or Second Regulated Market or admitted to trading in the Third Market. These are government bonds, federal treasury certificates, treasury notes, interest rate and government strips, corporate bonds…

Bond market Overview

The bond market is a primordial one: it is larger than all other markets put together and the Pacific Investment Management Company (PIMCO) is its biggest player. Co-founded by Bill Gross back in 1971, the California-based fund has $1.51trn dollars in assets under management (AUM). To put this number…

Bond market watch

Stanley Druckenmiller is introducing former Fed Gov. Kevin Warsh. Druckenmiller recounts that at last year’s conference he urged getting out of equities and into gold.The legendary investor jokes that that’s why he’s introducing this year instead of presenting. Kevin Warsh, who is often touted as a potential…