australian bond market

Thank you for inviting me to talk at the Economic Society here in Canberra. Today I am going to walk you through the current state of the Australian bond market. The bond market plays an important role in the financial structure of the Australian economy and it is timely to examine its structure and functioning with the financial system inquiry underway.

Thank you for inviting me to talk at the Economic Society here in Canberra. Today I am going to walk you through the current state of the Australian bond market. The bond market plays an important role in the financial structure of the Australian economy and it is timely to examine its structure and functioning with the financial system inquiry underway.

I will start today by providing an overview of the composition of the Australian bond market and how this has changed in recent years. Then, I will discuss more recent developments in the market since the start of 2013, focusing particularly on two trends that emerged last year: the nascent signs of deepening of the domestic corporate bond market and the pick-up in securitised issuance. I will also talk a little about the prospect for market-based finance, of which bond issuance is an important part, playing a larger role in the future than it currently does.

Shape of the Australian Bond Market

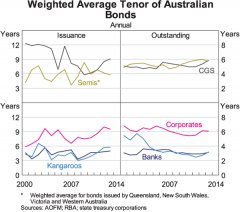

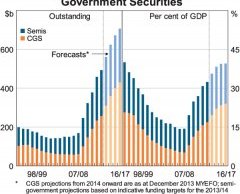

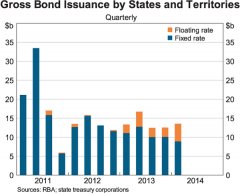

The evolution of the Australian bond market over the past several years has been shaped to a large extent by the fallout from the global financial crisis. Prior to the crisis, the market comprised mainly bonds issued by the Australian banks and asset‑backed securities. Together these accounted for just over half of the outstanding stock of Australian bonds in June 2007. Bonds issued by the public sector were a relatively small share of the market, at 16 per cent of the total outstanding (Table 1).

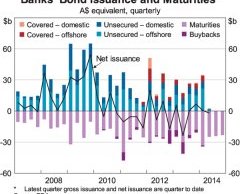

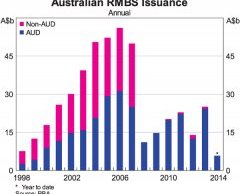

Overall, the size of the bond market in mid 2007 was equivalent to around 84 per cent of Australia's annual GDP. In the subsequent seven years the stock of Australian bonds on issue has increased to reach the equivalent of nearly 100 per cent of GDP. The increase has mainly been the result of debt issuance by the Commonwealth and state governments to finance their budget deficits as they sought to support economic growth through the crisis. Bank bond issuance has slowed down in the last couple of years as Australian banks have sought to shift towards more deposit funding. However, the stock of bank bonds on issue is significantly higher than it was just before the start of the global financial crisis, reflecting the strong issuance of bank bonds in 2008 and 2009 as the financial system was re-intermediated because other forms of non-bank financing dried up. One of the areas of the market that suffered the greatest impact from the crisis was asset‑backed securities, due to the loss of investor confidence in this asset class globally. This resulted in the stock of outstanding Australian asset-backed securities nearly halving, in nominal terms, and declining three-fold relative to GDP since mid 2007.

Overall, the size of the bond market in mid 2007 was equivalent to around 84 per cent of Australia's annual GDP. In the subsequent seven years the stock of Australian bonds on issue has increased to reach the equivalent of nearly 100 per cent of GDP. The increase has mainly been the result of debt issuance by the Commonwealth and state governments to finance their budget deficits as they sought to support economic growth through the crisis. Bank bond issuance has slowed down in the last couple of years as Australian banks have sought to shift towards more deposit funding. However, the stock of bank bonds on issue is significantly higher than it was just before the start of the global financial crisis, reflecting the strong issuance of bank bonds in 2008 and 2009 as the financial system was re-intermediated because other forms of non-bank financing dried up. One of the areas of the market that suffered the greatest impact from the crisis was asset‑backed securities, due to the loss of investor confidence in this asset class globally. This resulted in the stock of outstanding Australian asset-backed securities nearly halving, in nominal terms, and declining three-fold relative to GDP since mid 2007.

Table 1: Australian Bonds Outstanding*

Outstanding

($ billion)Outstanding

(per cent of GDP)Share of total

(per cent)Dec

2013Jun

2007Dec

2013Jun

2007Dec

2013Jun

2007Public sector

504

504

148

33

14

33

16

CGS

288

58

19

5

19

6

Semis

217

90

14

8

14

10

Financials

506

304

33

28

33

33

Banks

445

248

29

23

29

27

Non-bank financials

61

56

4

5

4

6

Corporate

233

136

15

13

15

15

Asset-backed securities

122

225

8

21

8

25

RMBS

104

204

7

19

7

22

CMBS

2

12

0

1

0

1

Other ABS

16

9

1

1

1

1

Kangaroos

158

103

10

10

10

11

Total

1522

916

98

84

100

100

Memo item:Australian dollar Eurobonds

53

68

3

6

3

7

* Fixed income securities with original maturity of one year or greater

Sources: ABS; RBA

Overview of Developments Since 2013

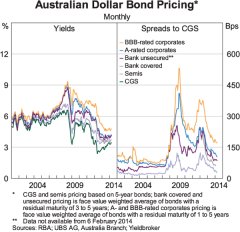

Conditions faced by Australian bond issuers have continued to improve since early 2013, reflecting the markedly better conditions in global financial markets as the global economic recovery has become more entrenched and as European sovereign debt concerns have eased.

Issuance has been generally strong and has been met by robust domestic and offshore demand. The only exception to this was the month of June which saw virtually no issuance of non-government bonds as issuers and investors stood on the sidelines while financial markets were assessing the prospects and implications of the start of the US Federal Reserve's tapering to its asset purchases program. However, this episode proved short-lived, with Australian and global bond market activity resuming quickly and continuing apace when tapering actually started in December.

More:

- Unlike most competitors, Trexle programming interface is distinguished by thoughtfulness and the ability to quickly integrate. Their Payment API has a set of all the necessary operations for making payments and then managing them using your personal payment gateway. The API allows you to embed payment services in your website or mobile application and refine the payment system interface in accordance with the preferences and needs of the client’s site. You can accept payments from any country in the world and integrate with ready-made integrations. To learn more about access to the payment gateway, contact Trexle.