USA apostille service - apostille documents. Birth certificate apostille.

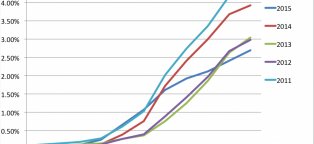

Rate

Bond market rates

Rates for home loans jumped in the latest reporting week, taking the benchmark back over a key threshold for the first time since May, mortgage provider Freddie Mac said Thursday. The 30-year fixed-rate mortgage averaged 4.03% in the…

Bonds rate of return

Yield is a general term that relates to the return on the capital you invest in a bond. There are several definitions that are important to understand when talking about yield as it relates to bonds: coupon yield, current yield, yield-to-maturity, yield-to-call and yield-to-worst. Let s start with the…

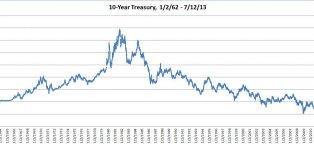

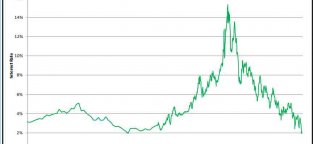

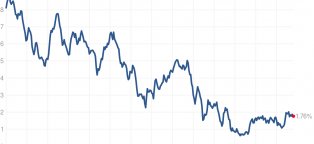

Us treasury 30 year bond rate history

From 1916 to early summer of 2016, the yields on 10 year U.S. treasury notes have varied widely, from a 100 year low in 2016, when the rate fell to less than 2 percent—1.71 percent in June of 2016—to a high for the same 100 year period of 14.59 percent in January 1982. For comparison purposes, note that…

I bonds rates history

The rate on series I savings bonds just went negative. How can that be? How are these things calculated? Actually, the rate is 0%, not negative. Here’s how it works. The earnings rate (called the “composite rate”) for series I bonds includes two parts: the fixed rate, which applies for the 30-year life…

state bonds rates

√ at a glance What is an EE bond? (EE bonds issued from May 2005 on) These EE bonds earn the same rate of interest (a fixed rate) for up to 30 years. When you buy the bond, you know what rate of interest it will earn. Treasury announces the rate each May 1 and November 1 for new EE bonds. Were older…

mortgage bonds rates

Mortgage rates for 30-year and 15-year fixed home loans moved higher, while 5/1 ARMs were unchanged today, according to a NerdWallet survey of mortgage rates published by national lenders Friday morning. The bond market, the major driver of mortgage rates, is still digesting the Federal Reserve’s latest…

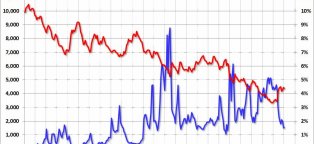

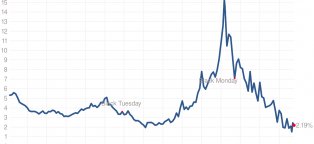

10 year bond yield and mortgage rates

Mortgage rates moved higher this week following a sharp increase in long-term bond yields. According to the latest data released Thursday by Freddie Mac, the 30-year fixed-rate average climbed to 3.96 percent with an average 0.6 point. (Points are fees paid to a lender equal to 1 percent of the loan…

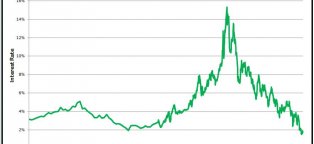

WSJ bond rates

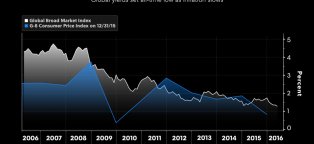

Falling bond yields have been a fixture of global markets for decades. The yield on the 10-year U.S. Treasury note hit its lowest level ever in July. Yield on the 10-year Treasury note Sept. 30, 1981 15.819% Why Bond Yields Have Been Falling: Weakening Outlook on Global Growth Global growth has been…

Uk government bonds historical rates

UK gilts are issued by HM Treasury and listed on the London Stock Exchange. On this page we list sources for UK gilt prices. A gilt is a UK Government liability in sterling, issued by HM Treasury and listed on the London Stock Exchange. There are two main types of gilts: conventional gilts and index-linked…

Government of Canada bond rate

Equity derivatives Currency derivatives Index derivatives Interest rate derivatives Underlying C$100, nominal value of a Government of Canada bond with a 6% notional coupon. Expiry cycle March, June, September and December. Price quotation Per C$100 nominal value. Minimum price fluctuation 0.01 = C$10…

30 year treasury bond rate history

30-year bond futures are part of the financial commodities futures sector in which the contract holder agrees to purchase or sell a bond on a specified date at a predetermined price. Bond contracts are standardized and are overseen by a regulatory agency that ensures a level of equality and consistency…

10 year treasury bond yield rate

The return on investment, expressed as a percentage, on the U.S. government s debt obligations (bonds, notes and bills). Looked at another way, the Treasury yield is the interest rate the U.S. government pays to borrow money for different lengths of time. Treasury yields don t just influence how much…

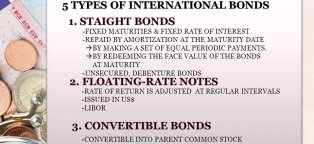

What are bond rates?

The fact that bond prices and yields move in opposite directions is often confusing to new investors. Bond prices and yields are like a seesaw: when bond yields go up, prices go down, and when bond yields go down, prices go up. In other words, a move in the 10-year Treasury yield from 2.2% to 2.6% indicates…

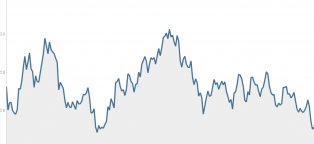

Bond yield rates

Probability of Rate Hike Is Rising: What It Means for Investors PART 2 OF 4 Interest rate and bond yield The ten-year US Treasury yield was close to its one-month high of 2.6% on March 13, 2017, amid expectations of a rise in the Fed’s key interest rate on March 15, 2017. The Treasury yield of the 30-year…

Bloomberg rates bonds

Yields have climbed past key points to signal further gains Gundlach sees 3% looming for Treasuries; Dalio says party over Is the bond rout over? You ain’t seen nothing yet and stock investors should take note. The global equity rally that’s repeatedly shrugged off rising geopolitical uncertainty now…

Government bonds uk rates

Gilts are bonds issued by the HM Treasury on behalf of the British Government. Traditionally they were gilt-edged certificates and the name has stuck. They help the Government to fund its borrowing. When you buy a gilt, you are effectively lending the Government money. In return, the Government promises…

United states treasury bond rate six-month

Bryan J. Noeth , Rajdeep Sengupta Government debt of the United States is typically issued in the form of U.S. Treasury securities. These securities—simply called Treasuries—are widely regarded to be the safest investments because they lack significant default risk. Therefore, it is no surprise that…

Fixed bonds rates

A fixed-rate bond is a bond that pays the same amount of interest for its entire term. The benefit of owning a fixed-rate bond is that investors know with certainty how much interest they will earn and for how long. As long as the bond issuer does not default, the bondholder can predict exactly what…

United states treasury bond rate

By law, income to the trust funds must be invested, on a daily basis, in securities guaranteed as to both principal and interest by the Federal government. All securities held by the trust funds are special issues of the United States Treasury. Such securities are available only to the trust funds…

Compare the market fixed rate bonds

If you have debts, pay those off first before fixing your savings If the interest cost of your debt is more than you d earn on savings you re better off paying down the debt. If you ve 1, on a credit card at 20% it costs 200 a year, assuming a constant balance. In savings at 2% you d earn 20 a year…

Government treasury bonds rates

A Treasury bill (T-Bill) is a short-term debt obligation backed by the U.S. government with a maturity of less than one year, sold in denominations of $1, up to a maximum purchase of $5 million. T-bills have various maturities and are issued at a discount from par. When an investor purchases a T-Bill…