Us treasury 30 year bond rate history

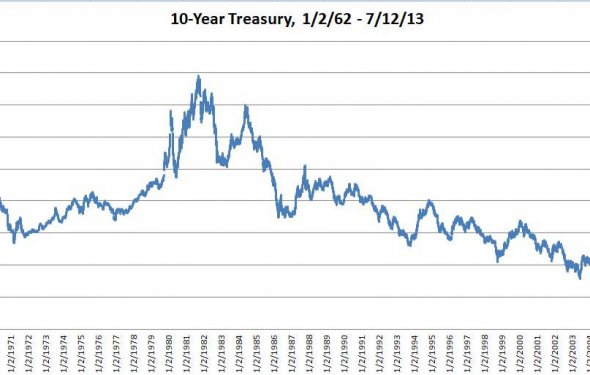

From 1916 to early summer of 2016, the yields on 10 year U.S. treasury notes have varied widely, from a 100 year low in 2016, when the rate fell to less than 2 percent—1.71 percent in June of 2016—to a high for the same 100 year period of 14.59 percent in January 1982.

For comparison purposes, note that the corresponding 1990 rate for the 10-year note was 8.21 percent, slightly lower than the 30-year bond rate.

In fact, all through the long historical period from 1916 to 2016 bond yields were never stable for long; they continually rose and fell.

Why Do Interest Rates and Yields on Bonds Rise and Fall?

Although investors traditionally hold bonds in their investment portfolios to counter the reputedly greater volatility of stocks, both financial instruments are volatile, differing only in degree. The difference between the 10-year note's high and low—14.59 percent and 1.71—is a more than eight-fold increase. An education paper issued by the Federal Reserve Bank in San Francisco points out five factors that influence the interest rates of the Treasury's shorter term T-Bills, but all five contribute at least as much to the offered rates on longer-term Treasury notes and bonds and all of them also affect yield.

- Demand: Periods of greater than usual financial uncertainty increase demand for financial instruments that are perceived to be especially safe—the U.S. government's debt instruments are almost universally considered the safest in the world. As a result of increased demand, investors accept lower rates and yields.

- Supply: The reason government bonds exist in the first place is that they provide a means of raising capital that the government may need for government initiatives, payroll or to service debt. When the U.S. government has a federal budget surplus, as it did in the period 1998-2000, it has less need for borrowed money and will issue fewer treasury notes and bonds. The decrease in the available supply means that the government can offer bonds with lower rates.

- Economic Conditions: The San Francisco Fed's white paper on bond rates points out that interest rates on bonds usually rise in bull markets and fall in bear markets.

- Monetary Policy: Bonds have more than one government function. In addition to raising money, bonds and their offered interest rates have an influence on the financial markets generally. The Fed doesn’t control long-term rates, of course, but its policy with regard to short-term rates sets the basis for yields on government bonds with longer maturities. After the banking/financial crisis of 2007-2008, the Federal Reserve kept interest rates as low as possible in order to make it easier for businesses to borrow money.

- Inflation: Actual inflation, but also inflation expectations in the financial community, tend to raise interest rates and to elevate bond yields—the effective interest rate of a bond selling for less than its issued rate. The cause of the elevated yields of the late 1970s and early 80s was the high inflation of that era which led U.S. Federal Reserve Chairman Paul Volcker to begin raising short-term interest rates dramatically during the early 1980s. In turn, resulted in higher rates and yields of all treasury instruments. Keep in mind, however, that in periods of high inflation rates, the real (or after-inflation) yield investors receive is lower than it appears.