WSJ bond rates

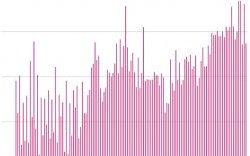

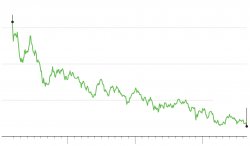

Falling bond yields have been a fixture of global markets for decades. The yield on the 10-year U.S. Treasury note hit its lowest level ever in July.

Falling bond yields have been a fixture of global markets for decades. The yield on the 10-year U.S. Treasury note hit its lowest level ever in July.

Yield on the 10-year Treasury note

Sept. 30, 1981

15.819%

Why Bond Yields Have Been Falling:

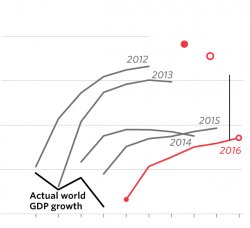

Weakening Outlook on Global Growth

Global growth has been weak, reflecting factors ranging from aging populations to rising debt levels to heavier regulation. Forecasters such as the International Monetary Fund have been cutting growth projections in response.

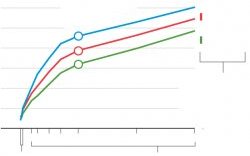

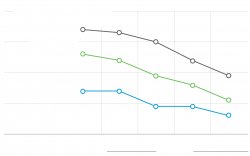

Forecasts for the world's gross domestic product, change from previous year

Forecasts are shown for the forecasting year and the next five years. Forecasts are made in April of each year.

2016 forecast for world GDP growth

this year and

in 2021

2010 forecast for world

GDP growth

in 2015

2010 forecast for world GDP growth

that year and

Soft Growth Has Caught Officials by Surprise

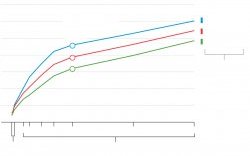

Even in the United States, where growth has been stronger than in Europe and Japan and steadier than in many emerging nations, bullish predictions have been mistaken, limiting the Federal Reserve’s capacity to raise short-term interest rates.

Median projections and actual ranges for the Fed’s interest-rate target

Inflation, Scourge of Bonds, Has Been Throttled

Slow growth is helping to keep a lid on inflation around the Western world, which is helping to increase the demand for bonds.

Slow growth is helping to keep a lid on inflation around the Western world, which is helping to increase the demand for bonds.

PCE index, change from a year ago, seasonally adjusted

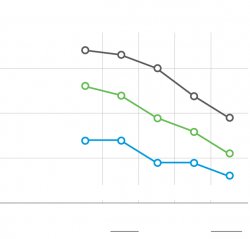

Central Banks Are Desperate to Stimulate Growth

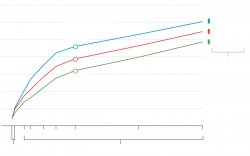

These persistent shortfalls have engendered an increasingly robust response from rich countries’ central banks. Their policies have centered on large purchases of their own government’s bonds, an approach known as ‘quantitative easing’ or QE for its effect of increasing central-bank assets.

Central banks’ holdings as a share of government debt outstanding

Signs of Desperation: Negative-Yielding Bonds

These government purchases have amplified the already sizable demand for safe bonds at a time when investors generally remain risk averse, reflecting the 2008 crisis and uneven economic growth. Some central banks have moved their policy rates into negative territory, resulting in further reductions in bond yields in those regions and boosting investor demand for higher-yielding debt elsewhere.

Some central banks have moved their policy rates into negative territory, resulting in further reductions in bond yields in those regions and boosting investor demand for higher-yielding debt elsewhere.

Ten-year sovereign debt yields that are now negative

The Global Reach for Yield

Negative yielding bonds in other countries make low-yielding U.S. Treasury debt relatively attractive, drawing more foreign buyers to purchase bonds here.

Percent of indirect bidding, a proxy for overseas demand, for each day the 10-year note is auctioned

(Largest percent of

foreign bidders)

Worries About Side Effects

Many investors believe central-bank liquidity created by bond purchases, which helps drive down yields, is recycled by investors into stocks, helping drive recent gains in the S&P 500. Some worry the gains make stocks vulnerable to a sudden reversal in sentiment.

S&P 500 Index and 10-year Treasury note yield

The Limits of Low-Rate Policy

Some fear that falling long-term yields risk becoming counterproductive. One fear is that by reducing the difference between short-term and long-term rates creates a flat or inverted yield curve (in which short-term rates are higher than long ones), indicating a recession is likely. What will this curve look like a year from now?

Yield curves showing Treasury yields at different maturities

10-year Treasury

note yield:

When the

Fed released

their interest-

rate projections

1, 3 or 6 months to maturity

(Short-term debt)

Years to maturity

(Long-term debt)

When the Fed

released their

interest-rate

projections