Bonds Interest Rates

Sponsors

Tips on what to do onset of cold Why was tamzin outhwaite in a wheelchair in new tricks How to get rid of pimple? How to make money in stocks How to download google maps? How to clear acne tips What are some good tips for parents to…

FAQ

How much vacancy in upsc 2022 why activities are important? when theory test will open? who engineering controls definition? which activities burn the most calories? who create google where to interview? where to find leader cliff when questions for kids? who s are whose how many skills to put on resume…

Resources

Residential real estate crowdfunding non technical entrepreneur distance mba best computer courses a good entrepreneur graduate certificate vocational schools near me pre seed funding for startups costco car rental enterprise online university courses curriculum maestro hazwoper training pharmacy degree…

Treasury bonds interest

Credit quality Treasury securities are considered to be of high credit quality and are backed by the full faith and credit of the U.S. government. That backing carries weight due to the federal government s taxing power and the relative size and strength of the U.S. economy. However, in August 2011 the…

Bond yields and interest rates

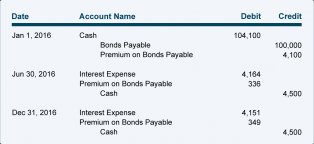

The market prices bonds based on the bond s particular characteristics. A bond s price changes on a daily basis, just like that of any other publicly-traded security, where supply and demand in any given moment determines that observed price. But there is a logic to how bonds are valued. Up to this point…

Bonds interest rates

When a bond is issued, it pays a fixed rate of interest called a coupon rate until it matures. This rate is related to the current prevailing interest rates and the perceived risk of the issuer. When you sell the bond on the secondary market before it matures, the value of the bond, not the coupon, will…

Bank bonds interest rates

The stock market caught wind of the rate move Thursday, and equities around the world responded negatively to rising yields. Bond strategists say if higher yields trigger a bigger sell off in stocks it could slow down the upward movement in interest rates, as investors will seek safety in bonds. Bond…

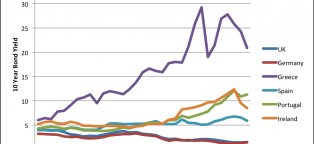

government bonds interest rates

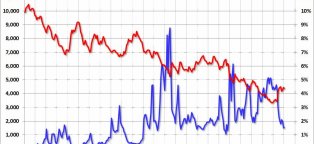

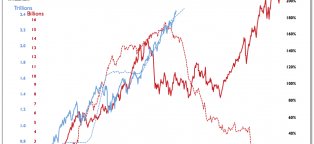

Longer-term interest rates are quite low around the world. Figure 1 below shows ten-year government bond yields since 1990 for the United States, Canada, Germany, the United Kingdom, and Japan. The downward trend is clear. Moreover, further sharp declines in longer-tem yields have occurred over the past…

Government bonds interest

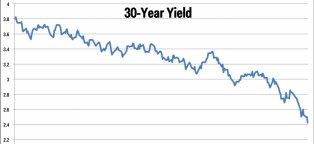

Dear Dr. Don, If I buy a 30-year U.S. Treasury bond, will I receive a monthly check for the interest earnings? Thanks, — Peter Pecuniary Dear Peter, U.S. Treasury securities that pay what’s called “coupon interest” make those payments semiannually. A 30-year U.S. Treasury bond falls into that category…

30 year Treasury bond interest rate

When the U.S. Federal Reserve hikes interest rates, it can be for a number of reasons, ranging from rising inflation to an overheated economy. Regardless of the reasons behind the Fed s rate hike, the impact of this decision is felt across different corners of the bond market world. Bonds are important…

Current Treasury bond interest rates

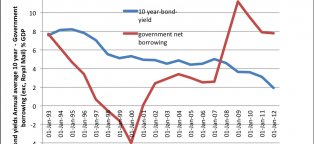

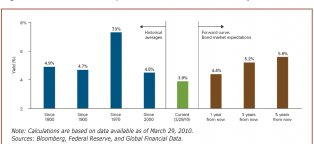

Today CBO’s Director testified before the Senate Budget Committee about the agency’s projections for the federal budget and the U.S. economy over the next 10 years, which were recently published in The Budget and Economic Outlook: 2017 to 2027 . Among those projections are CBO’s assessments of interest…

Bonds interest

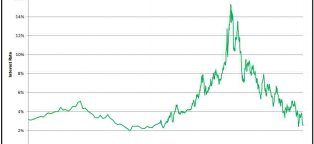

In a CNBC interview, the longtime central bank chief said the prolonged period of low interest rates is about to end and, with it, a bull market in fixed income that has lasted more than three decades. The current level of interest rates is abnormally low and there s only one direction in which they…

Corporate bonds and interest rates

Like all bonds, corporates tend to rise in value when interest rates fall, and they fall in value when interest rates rise. Usually, the longer the maturity, the greater the degree of price volatility. If you hold a bond until maturity, you may be less concerned about these price fluctuations (which…

Fixed bond interest rates

2. Fidelity commissioned Corporate Insight to study bond pricing, available online, for self-directed retail investors from five brokers that offer corporate and municipal bonds. The study compared online bond prices for over 20, municipal and corporate inventory matches between September 2nd and October…

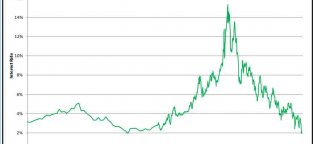

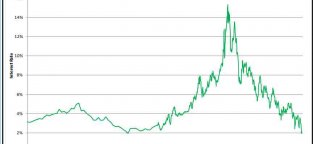

Historical bond interest rates

Take a tour of interest rates, financial indicators, and markets over the past century. This model reflects the history of interest rates since 1900. The model dynamically presents the yield curve across each year. The yield curve is the graphical depiction of interest rates across maturities from one…

Bond Market and interest rates

Ownership of a bond is the ownership of a stream of future cash payments. Those cash payments are usually made in the form of periodic interest payments and the return of principal when the bond matures. In the absence of credit risk (the risk of default), the value of that stream of future cash payments…