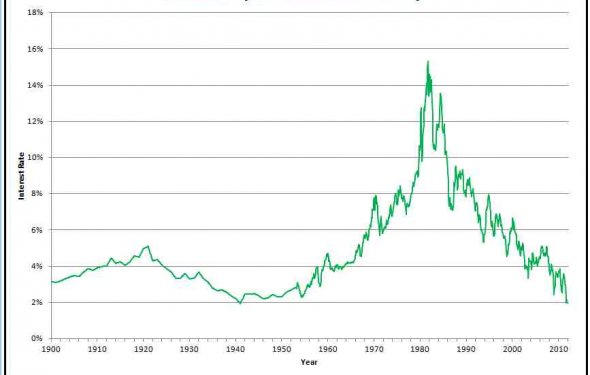

Treasury bonds interest

Credit quality

Treasury securities are considered to be of high credit quality and are backed by the full faith and credit of the U.S. government. That backing carries weight due to the federal government's taxing power and the relative size and strength of the U.S. economy. However, in August 2011 the long-term sovereign credit rating on the United States of America was downgraded to AA+ from AAA by the ratings agency, reflecting increasing concerns about the U.S. budget deficit and its future trajectory.

Tax advantages

income from Treasury bonds is exempt from state and local income taxes, but is subject to federal income taxes. Other components of your return, however, may be taxable when the bonds are sold or mature. If you buy a bond for less than on the secondary market (known as a market discount) and you either hold it until or sell it at a profit, that gain will be subject to federal and state taxes. Buying a bond at market discount is different than buying a bond at . When a bond is sold or matures, gains resulting from purchasing a bond at market discount are treated as capital gains while OID gains are treated as a type of income.

Liquidity

Large volumes of Treasuries are bought and sold throughout the day by a wide range of institutions, foreign governments, and individual investors so they are considered to be highly liquid. Investors considering Treasury securities have opportunities to buy bonds both at regularly scheduled auctions (see Auction Schedule) and in the secondary market, which is one of the world's most actively traded markets. Investors can find Treasury bills, notes, and bonds posted with active and . Spreads (the difference in price between the bid and offer) are among the most narrow available in the bond market. Investors should, however, be aware that at certain times, such as when important economic data is released, Treasury securities can be at their most volatile.

Choice

Treasuries come in maturities of 4 weeks to 30 years, with longer maturities usually offering higher coupons. Treasuries also come in various structures, like Treasuries with coupons, Treasuries, and Treasury inflation-protected securities (TIPS), whose principal and returns adjust to reflect changes in the consumer price index.