5 year Canada bond rate

Hello

Rates continue to fall:5 year fixed Quick Close is at 3.69% (3.85% regular)Close variable at P+0.5% (3.00%)

Many people don't realize that there is a very strong correlation between mortgage rates and the Government of Canada bond yields. Bond yields change daily and so can fixed mortgage rates.

What's going on with mortgage rates?

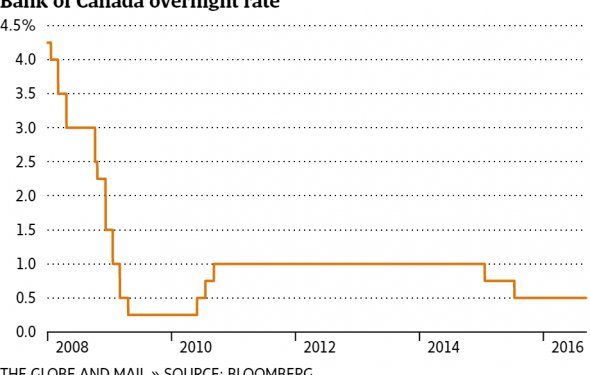

Many things affect mortgage rates but the single biggest item is Government of Canada bond yields.Government bonds are 100% guaranteed to be repaid, but mortgages are not; therefore mortgages carry more risk of default or early repayment, which could potentially disturb the return on the investment. Therefore, mortgage rates must be priced higher to compensate for that risk.

But how much higher are mortgages priced? In a normal market, the average "spread" or markup above the 100% secured government bonds is about 120 basis points, or 1.2%. That markup - the spread relationship - widens and contracts with a range of market conditions, investor appetites and supply of available product - as well as the presence of competing investment opportunities, like corporate bonds or domestic (or foreign) equity markets.

The relationship between government bonds and mortgage rates isn't a fixed one, but one that changes with market conditions. The recent financial crisis has greatly affected the spread.

There has been a tremendous move from "risky" assets, such as mortgages, into "safer" assets such as government bonds. In fact, there has been so much demand for safety - so much money pouring in to them - that the effective yield for many government bonds are less than 2%, while mortgage didn't move.

This means that the difference between a "risk-free" 5-year government bond and "risky" 5-year fixed mortgage rates is extraordinarily high. These are the wide 'spreads' you may hear referenced in popular financial media.

This larger than normal spread will dissipate with time and will push fixed mortgage rates lower as we can already see happening.