Bond market calendar

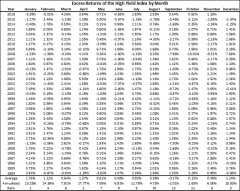

One of my favorite market anomalies is well underway, and it likely has meaningful implications for Seeking Alpha's fixed income investors. Since the advent of the modern high-yield debt market in the early 1980s, there has been a bankable calendar trade that has persisted. In the table below, readers can see that the highest excess returns over Treasuries in the high-yield market have historically been experienced in December (+1.76%) and January (+1.24%).

One of my favorite market anomalies is well underway, and it likely has meaningful implications for Seeking Alpha's fixed income investors. Since the advent of the modern high-yield debt market in the early 1980s, there has been a bankable calendar trade that has persisted. In the table below, readers can see that the highest excess returns over Treasuries in the high-yield market have historically been experienced in December (+1.76%) and January (+1.24%).

These two months, which make up one-sixth of the calendar year, have historically generated one-third of the returns of the high-yield bond market.

This reliable calendar effect is likely driven by a confluence of factors. Unlike equity markets, which will produce only several dozen domestic IPOs in even the most bullish of years, multiple, new high-yield bond issues will come to market each day when credit investors are receptive. While we have seen an uptick in primary supply in the high-yield market in the second half of 2016, markets still slow down materially around the Christmas holiday and early in the new year. In a dealer-driven market as opposed to the exchange-traded equity markets, market participants need to be at their desks to support deal flow. Issuers will obviously not bring deals if a market holiday slackens demand, increasing yield and interest expense on term debt that will be outstanding for many years. This is an especially acute issue for more levered high-yield borrowers who must remain focused on financing costs. This temporary absence of supply combined with a re-setting of return objectives at high-yield buyers at the beginning of the calendar year could lead to a favorable demand/supply imbalance that increases prices early in the new year.

Astute observers will note that this calendar effect did not hold over the last two years. December 2015 and January 2016 were each month's worst monthly excess returns in the 30-plus year dataset. Returns were also weak in late 2014 and early 2015. While this could be a sign that the efficacy of this trade is waning, I would counter that the impact of falling oil prices had a disproportionately negative impact on the market that swamped the typical spread tightening that the holiday-influenced supply/demand imbalance creates.