Bond market Bloomberg

While Bloomberg is commonly used across asset classes, it is perhaps most prevalent within the bond market. While some individuals may shy away from the bond market due to its institutional nature, even these investors will find that monitoring the bond market will help them better understand movements in stock, commodity, and forex markets. In this section, we will look at a brief overview of some of the functions available for analyzing government, corporate and municipal bonds. Keep in mind that this is only a tiny fraction of the tools available for analyzing the bond market, and that experimenting with the terminal will provide a wealth of additional functions.

While Bloomberg is commonly used across asset classes, it is perhaps most prevalent within the bond market. While some individuals may shy away from the bond market due to its institutional nature, even these investors will find that monitoring the bond market will help them better understand movements in stock, commodity, and forex markets. In this section, we will look at a brief overview of some of the functions available for analyzing government, corporate and municipal bonds. Keep in mind that this is only a tiny fraction of the tools available for analyzing the bond market, and that experimenting with the terminal will provide a wealth of additional functions.

Government Bonds

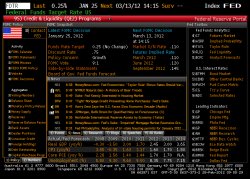

Government bonds serve as the foundation of the financial markets, and changes in the level of interest rates impact virtually every other investment option. Therefore, even casual investors would do well to utilize the tools Bloomberg offers for tracking interest rates and the Federal Reserve.

Federal Reserve interest rate movements often produce profound changes in the investment environment. Bloomberg provides a number of functions for monitoring and tracking Federal Reserve policy changes, as well as speeches by various Federal Reserve members. The function below serves as a "homepage" for monitoring the Federal Reserve. This page displays the most recent Federal Reserve policy movement, as well as the date of the next FOMC meeting and market forecasts for what the outcome of that meeting will be. The page also contains scrolling news headlines, links to a calendar of upcoming Federal Reserve speeches and meetings, and important economic releases that serve as leading indicators of the strength of the economy.

Federal Reserve "Homepage"

Federal Reserve "Homepage"

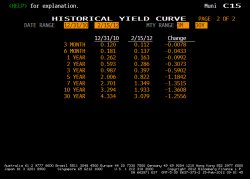

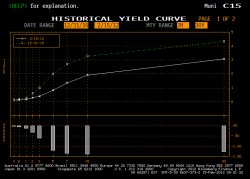

In addition to tracking the Federal Reserve, Bloomberg can also be used to monitor changes in interest rates. The function below is used to track the yield curve. (The yield curve is simply a graph of the level of interest rates for Treasuries of various maturities.) This information can be viewed in both graphical and text format, and can be customized for whatever date range users wish to see. Note: for advanced users, yield curve information is also available for a variety of other instruments in addition to Treasury securities.

Treasury Yield Curve Function in Text Format

Treasury Yield Curve Function in Graph Format

Corporate Bonds

Bloomberg is an excellent tool for analyzing corporate bonds. Some common tools are discussed below.

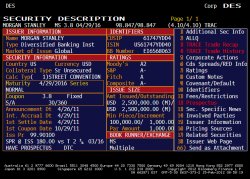

As with equities, there are basic description pages for bonds. However, some of the information displayed is different, as it is specific to bonds. As with equities, this is a good starting point when analyzing a corporate bond and also provides a menu of other functions that may be of interest.

Basic Description Page for a Morgan Stanley Corporate Bond

Basic Description Page for a Morgan Stanley Corporate Bond

Investors in corporate bonds (as well as other types of bonds and stocks) may be interested in what the credit ratings of a particular security are. This information can be found on the basic description page, but more detail can also be found by entering into the Bloomberg. Doing so brings up a page with details on the credit ratings from the various rating agencies, as well as ratings outlooks and watches.

Credit Rating Function

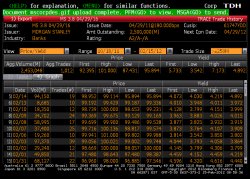

Unlike equities, bonds do not trade on a centralized exchange, and obtaining accurate pricing information can be difficult. However, this is gotten easier with the advent of the TRACE reporting system, which requires dealers to post prices shortly after completing a trade. A summary of recent price activity can be accessed via Bloomberg, as displayed below.

Trade History Function

Advanced users will find that Bloomberg also has a wide range of capabilities for analyzing and evaluating corporate bonds (as well as other types of bonds.) Describing the full range of these capabilities is beyond the scope of this article (and beyond the interest of many readers.) However, the screenshot displayed below will give an example of the type of analytics users will find on Bloomberg. Interested readers can then explore these analytics in greater detail in order to determine which work best for them. As always, if you have specific questions about these capabilities while using the Bloomberg, you can call or instant message the Bloomberg help desk for assistance.

Corporate Bond Analysis & Valuation Function

Municipal Bonds

As with government and corporate bonds, there are host of functions within Bloomberg for analyzing and tracking the municipal bond market as well as for valuing individual securities. Many of the screens are similar to those described in the sections above (i.e. the description pages, or the credit ratings pages) while others are unique to municipal bonds. One such function is displayed below. As investors in the municipal market realize, new issuance drives the market, and investors often make their purchases from this new issuance as opposed to the secondary market. The function below displays the new issuance calendar for the municipal bond market. The screen can be customized to view securities issued across various date ranges, from a particular state, or meeting other specific criteria.