Bond market rates

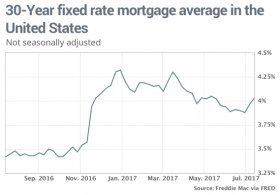

Rates for home loans jumped in the latest reporting week, taking the benchmark back over a key threshold for the first time since May, mortgage provider Freddie Mac said Thursday.

Rates for home loans jumped in the latest reporting week, taking the benchmark back over a key threshold for the first time since May, mortgage provider Freddie Mac said Thursday.

The 30-year fixed-rate mortgage averaged 4.03% in the July 13 week, while the 15-year fixed-rate mortgage averaged 3.29%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.21%. All three products rose seven basis points during the week.

Those rates don’t include fees associated with obtaining mortgage loans.

The 10-year Treasury yield TMUBMUSD10Y, -0.40% has been somewhat flat during the week, but changes in mortgage rates often follow moves in Treasurys with a lag, and government bonds have surged in recent weeks as investors start to price in central bank tightening.

After the November election, when investors sold bonds in anticipation of a pickup in inflation, many economists believed mortgage rates would finally turn higher. Analysts surveyed by MarketWatch forecast a 4.50% 30-year fixed rate throughout the year. But so far this year, the 30-year fixed has averaged 4.07%.

Traffic stats