government bonds interest rates

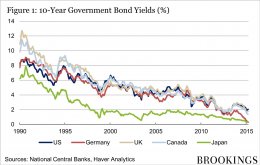

Longer-term interest rates are quite low around the world. Figure 1 below shows ten-year government bond yields since 1990 for the United States, Canada, Germany, the United Kingdom, and Japan. The downward trend is clear. Moreover, further sharp declines in longer-tem yields have occurred over the past year or so. For example, in the US, ten-year Treasury yields have fallen from around 3 percent at the end of 2013, to about 2.5 percent during the summer of 2014, to around 1.9 percent today. The recent renewed decline was unexpected by most observers, including me. Why are longer-term interest rates so low? And why have they fallen even further recently, despite signs of strength in the US economy?

Longer-term interest rates are quite low around the world. Figure 1 below shows ten-year government bond yields since 1990 for the United States, Canada, Germany, the United Kingdom, and Japan. The downward trend is clear. Moreover, further sharp declines in longer-tem yields have occurred over the past year or so. For example, in the US, ten-year Treasury yields have fallen from around 3 percent at the end of 2013, to about 2.5 percent during the summer of 2014, to around 1.9 percent today. The recent renewed decline was unexpected by most observers, including me. Why are longer-term interest rates so low? And why have they fallen even further recently, despite signs of strength in the US economy?

To explain the behavior of longer-term rates, it helps to decompose the yield on any particular bond, such as a Treasury bond issued by the US government, into three components: expected inflation, expectations about the future path of real short-term interest rates, and a term premium. At present, all three components are helping to keep longer-term interest rates low. Inflation is low and expected to remain so, so lenders are not demanding higher returns to compensate for anticipated losses in their purchasing power. Short-term interest rates are also expected to remain low, as bondholders appear pessimistic about growth prospects and the sustainable returns to capital in coming years. When short-term rates are expected to remain low, longer-term rates tend to get bid down as well.

Inflation is low and expected to remain so, so lenders are not demanding higher returns to compensate for anticipated losses in their purchasing power. Short-term interest rates are also expected to remain low, as bondholders appear pessimistic about growth prospects and the sustainable returns to capital in coming years. When short-term rates are expected to remain low, longer-term rates tend to get bid down as well.

The focus of this post, though, is on the behavior of term premiums—the third component of bond yields. Briefly, a term premium is the extra return that lenders demand to hold a longer-term bond instead of investing in a series of short-term securities (a new one-year security each year, for example). Typically, long-term yields are higher than short-term yields, implying that term premiums are usually positive (investors require extra compensation to hold longer-term bonds instead of short-term securities).

Term premiums cannot be directly observed but must be estimated from data on short-term and longer-term interest rates. Figure 2 below shows the ten-year yield on US government bonds and the associated term premium since 1961, as estimated in recent work by Tobias Adrian, Richard K. Crump, and Emanuel Moench at the Federal Reserve Bank of New York. For example, on January 2 of last year, an investor holding a ten-year Treasury bond earned a 3.2 percent yield, of which 1.6 percentage points (the estimated term premium) was the investor’s compensation for holding a longer-term security. As the figure shows, like overall yields, term premiums have generally trended down since the early 1980s. The figure also shows the sharp decline in both longer-term yields and term premiums over the past year or so.

So what moves term premiums? The key factors are (1) changes in the perceived riskiness of longer-term securities and (2) changes in the demand for specific securities (or classes of securities) relative to their supply.