Bond market Bubble burst

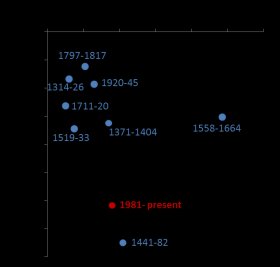

“Looking back over eight centuries of data, I find that the 2016 bull market was indeed one of the largest ever recorded, ” he wrote, using this chart for some perspective on the 36-year run bond run. “Only two previous episodes — the rally at the height of Venetian commercial dominance in the 15th century, and the century following the Peace of Cateau-Cambrésis in 1559 — recorded longer continued risk-free rate compressions.”

“Looking back over eight centuries of data, I find that the 2016 bull market was indeed one of the largest ever recorded, ” he wrote, using this chart for some perspective on the 36-year run bond run. “Only two previous episodes — the rally at the height of Venetian commercial dominance in the 15th century, and the century following the Peace of Cateau-Cambrésis in 1559 — recorded longer continued risk-free rate compressions.”

And what does it all mean? “History suggests this reversal will be driven by inflation fundamentals, and leave investors worse off than the 1994 ‘bond massacre, ’” Schmelzing said.

He was referring to the bond market’s meltdown two decades ago, when the 30-year long bond’s yield soared more than 150 basis points in a matter of months to 7.75% after Fed Chairman Alan Greenspan hiked rates in the wake of the 1991 recession.

Schmelzing warned that, in the current environment, the combination of a steepening bond-yield curve, Fed tightening and inflation could have painful implications for investors. “By historical standards, this implies sustained double-digit losses on bond holdings, subpar growth in developed markets and balance-sheet risks for banking systems with a large home bias, ” he said.